maine tax rates for retirees

Ad TD Ameritrade Offers IRA Plans With Flexible Contribution Options. A manual entry will be made using the Maine State wages found in Box 14 of 1099-R.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement.

. Ask an Edelman Financial Engines advisor today. Ad Compare Your 2022 Tax Bracket vs. Discover Helpful Information and Resources on Taxes From AARP.

Experienced Support Exceptional Value Award-Winning Education. For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a.

Maine tax rates for retirees. Before the official 2022 Maine income tax rates are released provisional 2022 tax rates are based on Maines 2021 income tax brackets. 2 hours agoThe Skowhegan Board of Assessors on Thursday lowered the tax rate from 1835 to 1748 per 1000 worth of valuation but that doesnt necessarily mean tax bills will be lower.

To help with your pre-move research click on any state in the map below for a detailed summary of state and local taxes on retirement income real property every-day. Retirement income exclusion from 35000 to 65000. 404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes.

Subtract the amount in Box 14 from Box 2a. Less than 44950 for joint filers 715 on. Ad Our experienced advisors can help you reach your retirement goals.

If you are a public. Your 2021 Tax Bracket to See Whats Been Adjusted. The exemption increase will take place starting in January 2021.

The income tax rates are graduated with rates ranging from 58. Are you saving enough for retirement. These voluntary programs can help eligible public school teachers supplement their retirement.

800-352-3671 or 850-488-6800 or. State Income Tax Range. If you believe that your refund may be.

Maine is not the best state in terms of retirement taxes. The 2022 state personal income tax brackets are. Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement incomes.

58 on taxable income less than 22450 for single filers. Individual Income Tax 1040ME Maine generally imposes an income tax on all individuals that have Maine-source income. Open an Account Today.

Increased the exemption on income from the state teachers retirement system from 25 to 50. 1418032 - 1289097. MaineSTART offers both Traditional pre-tax and Roth after-tax accounts.

Property tax exemption for seniors 65 and. Maine with a tax burden of just over 10 is the ninth highest in the country. See below Pick-up Contributions.

For deaths in 2020 the estate tax in maine applies to taxable estates with a value over.

Maine Estate Tax Everything You Need To Know Smartasset

Maine Retirement Tax Friendliness Smartasset

Ask Hannah Holmes Your Home Maintenance Questions Answered Home Maintenance Old Farm Houses Help Wanted

Pros And Cons Of Retiring In Maine Cumberland Crossing

Compare Renting Vs Buying You May Be Surprised Rent Maine Real Estate Rent Vs Buy

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

Tax Maps And Valuation Listings Maine Revenue Services

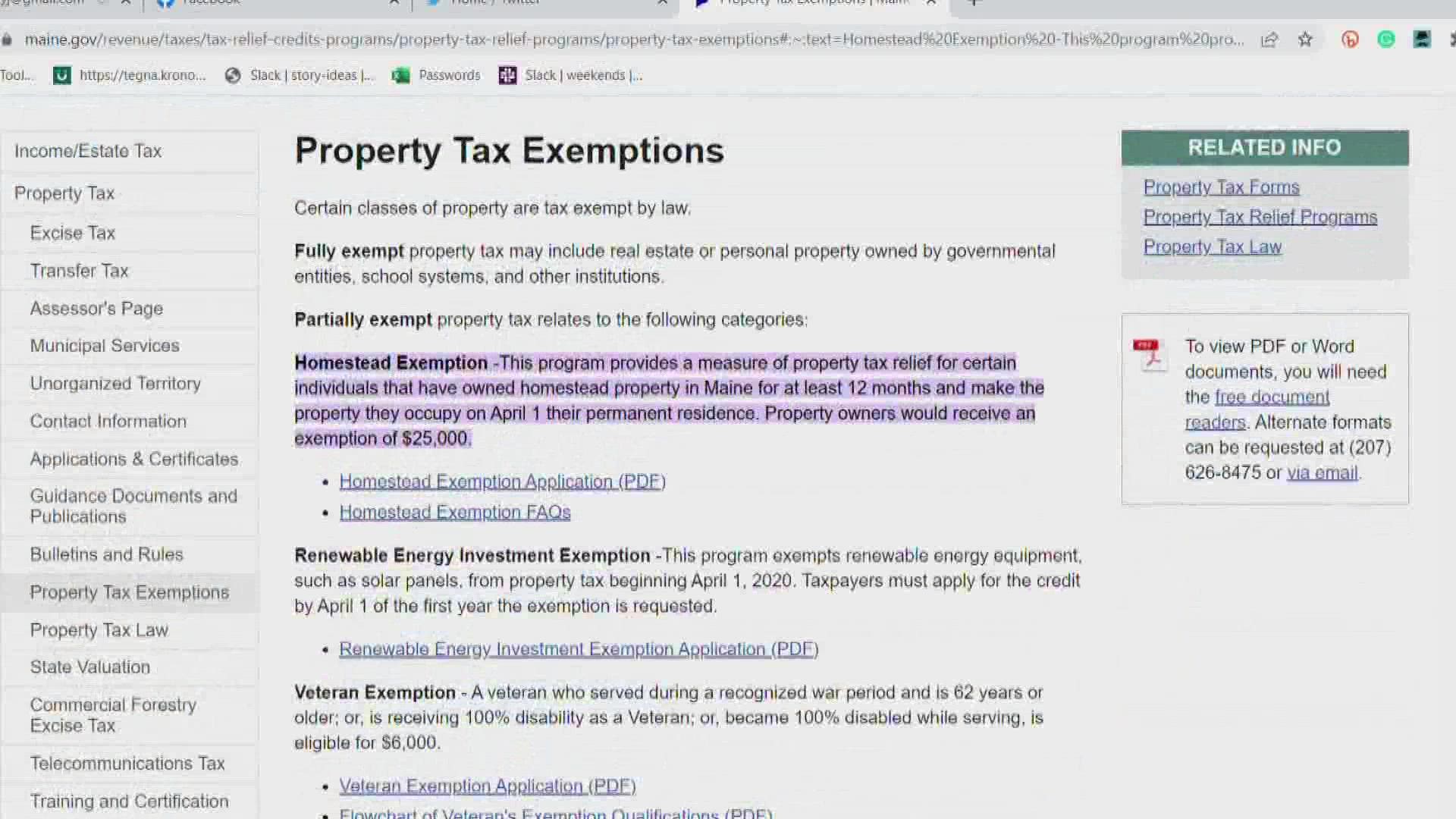

Older Mainers Are Now Eligible For Property Tax Relief Newscentermaine Com

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

Maine Property Tax Rates By Town The Master List

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Pin On Disability Social Security Retirement

York Property Tax Rate Falls As Town S Valuation Climbs 15 In One Year Maine In The Fall Property Property Tax

Military Retirees Retirement Retired Military Military Retirement

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

Cigarette Excise Taxes In Select States Per Pack Infographic Http On Wsj Com K81nby Infographic The Selection Tax